Yes, you can, but let’s cover the important stuff first.

Funding an HSA is often not an option for many health savings account (HSA) holders. Industry averages are that 20% or more of HSA users never fund their account. The lack of funding can be due to not having enough discretionary income to contribute to their account, not thinking one will have medical expenses to worry about, or lack of knowledge and understanding of how HSAs work, and especially all the different things one can pay for with an HSA.

What is an HSA?

An HSA is both a means of covering qualified healthcare expenses tax-free and a tax-free savings vehicle that can help you cover both medical and non-medical expenses in retirement. HSAs belong to (and are managed by) the account holder, so if you leave a job where you have contributed to an HSA, it’s a portable asset that can come with you to your next position. This makes it a great option for self-employed individuals. Let’s start with how you got here in the first place.

Starting with your HDHP

HSAs are only available in tandem with high deductible health plans (HDHPs), and you can only contribute to an HSA if you’re enrolled in one. Once you enroll, you must fully open your account — while you do not need to fund your HSA, you just need to make sure your account is fully established by your HSA provider. This is an important step because after your HSA is open, any eligible expenses from here on out help you benefit greatly from your HSA.

Pro tip: Put a minimal amount in your HSA account (say $5) that way your account will remain open and your HSA provider cannot close your account.

Where does the ‘no initial pre-funding’ come in?

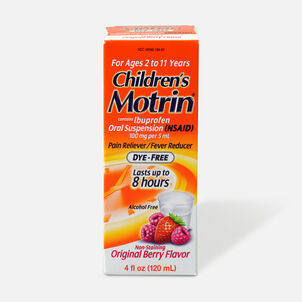

As stated above, you must have an open HSA. Once you do, you must learn that chances are, a lot of the items you are already buying are HSA eligible. So that means you must explore the world of eligibility and just how many of your everyday essentials and medicine cabinet favorites are eligible. The best place to start is with our Eligibility List — the web’s most comprehensive list of products and services eligible for tax-free spending.

Once you’ve done this, simply continue to buy these items as you are today — from eligible pain relievers to sunscreen, baby & mom products and much more, HSA Store carries all of your favorites with 100% guaranteed eligibility.

We even help you track and store all of your receipts from purchases made at HSA Store in one safe place with our Expense Dashboard. All HSA Store purchases paid for out of pocket (meaning with a regular credit card, debit card, cash, or in other words, not with your HSA) will be marked as “Eligible for Reimbursement.”

Now for the exciting part: when you’re ready, you can make a one time pre-tax contribution to your HSA directly from your paycheck in that amount (remember to always check with your employer on how this can be done). Once the amount is in your HSA, you can request a reimbursement from the HSA into your checking account. This means you have almost no impact on your cash flow (depending on how long it takes your HSA administrator to make the transfer). It’s just that simple — because you’ve reduced your taxable income by the amounts you've contributed from your payroll to your HSA, you've effectively saved an estimated 27%* on those purchases.

As discussed, you can benefit from your HSA without ever needing to make an initial pre-funding. Just make sure your HSA is open, save your receipts for eligible purchases, fund the account, and reimburse yourself right after.

Note, we are not tax professionals, nor should this article be considered professional tax or financial advice. To find the best solutions for your needs, be sure to speak to a qualified tax or financial professional before making any decisions.

*27% in tax savings assumes pre-tax HSA contributions, a 22% federal tax and a 5% state tax (does not contemplate APR or effective rate of return). For illustrative purposes only. Individual earnings may vary. Note: Pre-tax HSA contributions not used for qualified medical expenses are subject to a 20% income tax penalty.

-

Thank you for visiting the HSA Store Learning Center! Don’t forget to follow us for more helpful tips on Facebook, Instagram, and Twitter!

.png)